Solventum Corporation (SOLV) is a healthcare company that develops, manufactures, and commercializes a broad portfolio of medical, surgical, dental and health information technology products and services for customers and patients. The company was spun off from 3M’s healthcare division in April 2024, inheriting decades of established healthcare expertise and operations. Solventum is headquartered in Maplewood, Minnesota and has a market cap of $13.9 billion.

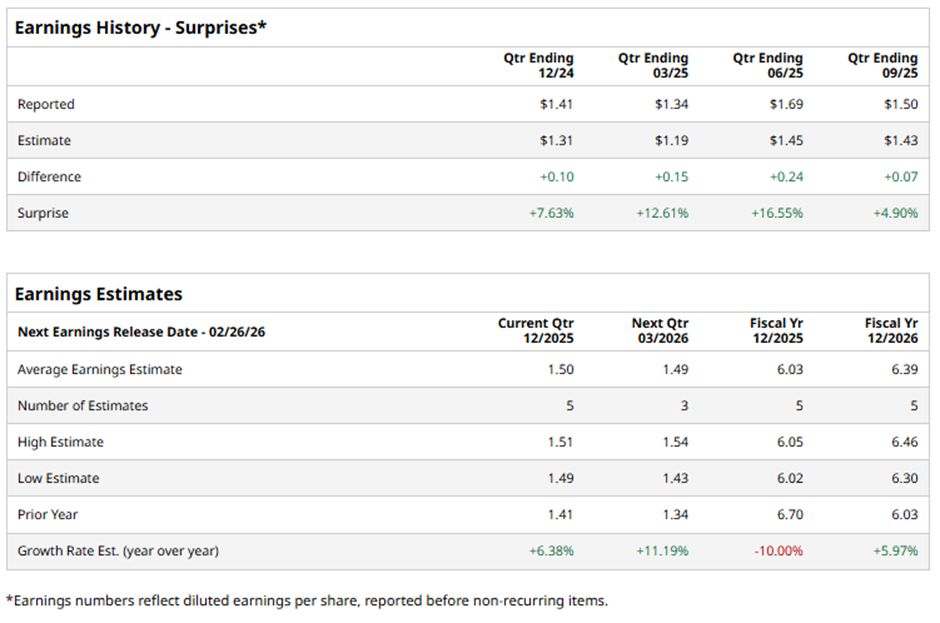

The healthcare company is expected to announce its fiscal fourth-quarter earnings for 2025 soon. Ahead of the event, analysts expect SOLV to report a profit of $1.50 per share on a diluted basis, up 6.4% from $1.41 per share in the year-ago quarter. The company beat the consensus estimates in each of the past four quarters, which is noteworthy.

For the full year, analysts expect SOLV to report EPS of $6.03, down 10% from $6.70 in fiscal 2024. However, its EPS is expected to rise 6% year-over-year to $6.39 in fiscal 2026.

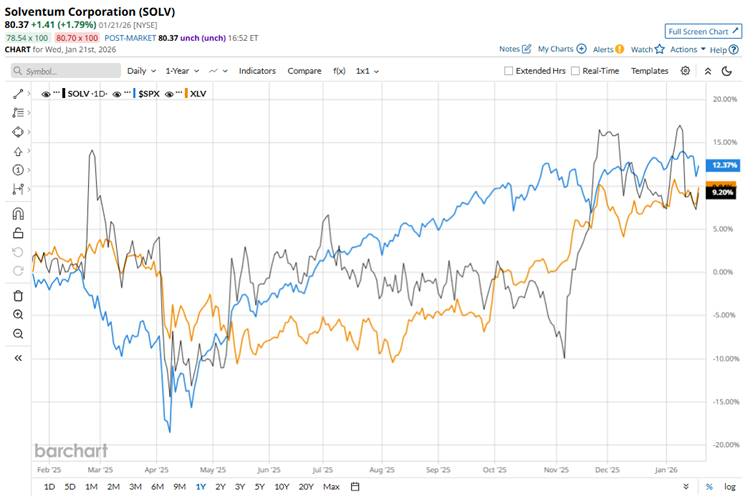

SOLV has lagged behind the S&P 500 Index’s ($SPX) 13.7% gains over the past 52 weeks, and the Health Care Select Sector SPDR Fund’s (XLV) 11.1% returns, with shares up 8.6% during this period.

SOLV climbed as investors rewarded the company’s stronger-than-expected financial performance and strategic progress. Solventum consistently beat earnings and revenue estimates across several quarters, boosting confidence in its execution of growth and transformation plans.

In Q3 2025 (reported on Nov. 6), Solventum reported revenues of about $2.1 billion, up marginally year-over-year and 2.7% organically compared with Q3 2024. Its adjusted EPS came in at $1.50, beating the consensus estimate but below the Q3 2024 adjusted EPS of $1.64.

Management also raised its full-year 2025 EPS guidance and maintained a positive outlook on organic growth and cost initiatives, which boosted optimism among investors. Solventum raised its adjusted EPS guidance to a range of $5.98 to $6.08 for the full year, up from the prior outlook of $5.88 to $6.03. The stock rose following the earnings release with 7.9% intraday gains on Nov. 7.

Analysts’ consensus opinion on SOLV is reasonably bullish, with a “Moderate Buy” rating overall. Out of 14 analysts covering the stock, six advise a “Strong Buy” rating, seven give a “Hold,” and one recommends a “Strong Sell.” SOLV’s average analyst price target is $91.18, indicating a potential upside of 13.5% from the current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Stocks Set to Extend Rally After Trump’s Greenland Pivot, U.S. PCE Inflation and GDP Data in Focus

- As Taiwan Semi Hikes Its Dividend 20%, Should You Buy TSM Stock?

- Apple Just Claimed the Top Spot in the Chinese Smartphone Market. What Does That Mean for AAPL Stock in 2026?

- Dear Apple Stock Fans, Mark Your Calendars for January 29