Arm Holdings plc - American Depositary Shares (ARM)

126.89

+1.61 (1.29%)

NASDAQ · Last Trade: Feb 18th, 12:20 AM EST

Investing in these top Canadian stocks can provide growth and income-earning potential for any portfolio.

Via The Motley Fool · February 17, 2026

In a watershed moment for the digital infrastructure sector, Equinix, Inc. (NASDAQ: EQIX) has set a new benchmark for the industry, forecasting a record $10 billion revenue outlook for 2026. The announcement, delivered during the company's early February earnings call, sent shares surging over 10% as investors pivoted their focus

Via MarketMinute · February 17, 2026

According to a 13F filing on its website from Tuesday, Nvidia had sold its $177 million position in Applied Digital as of Dec. 31, 2025.

Via Stocktwits · February 17, 2026

In a move that signals a massive consolidation in the medical technology sector, Danaher Corporation (NYSE: DHR) announced on February 17, 2026, that it has entered into a definitive agreement to acquire Masimo Corporation (NASDAQ: MASI) for approximately $9.9 billion. The all-cash deal, valued at $180 per share, represents

Via MarketMinute · February 17, 2026

Amazon's size likely influences how much effect this business will have on the company.

Via The Motley Fool · February 17, 2026

As the global retail landscape prepares for a pivotal update, all eyes are on Walmart Inc. (NYSE:WMT) as it readies its fourth-quarter fiscal 2026 earnings report scheduled for the morning of February 19, 2026. Following a tumultuous end to 2025—marked by a record-breaking 43-day federal government shutdown and

Via MarketMinute · February 17, 2026

As the 2026 financial calendar kicks into high gear, the banking sector remains the ultimate barometer for the health of the American economy. JPMorgan Chase (NYSE: JPM) set the tone this January with a fourth-quarter 2025 earnings report that showcased a "fortress balance sheet" capable of weathering both domestic shifts

Via MarketMinute · February 17, 2026

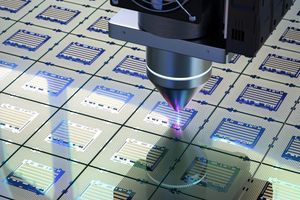

As of February 17, 2026, Intel Corporation (Nasdaq: INTC) finds itself at the most critical juncture in its 58-year history. After a tumultuous 2024 that saw the company removed from the Dow Jones Industrial Average and report a staggering $18.7 billion net loss, the "Silicon Giant" is currently in the throes of a high-stakes transformation. [...]

Via Finterra · February 17, 2026

As the retail landscape braces for the final tallies of the fiscal year, all eyes are on Walmart (NYSE: WMT), which is scheduled to report its fourth-quarter 2026 earnings on the morning of February 19. Two days ahead of the release, the consensus among analysts is that the Bentonville giant

Via MarketMinute · February 17, 2026

As of February 17, 2026, Occidental Petroleum (NYSE: OXY) stands at a pivotal crossroads in its century-long history. Known traditionally as a Permian Basin powerhouse, the company is aggressively rebranding itself as a leader in the global energy transition. With its fourth-quarter 2025 earnings report scheduled for release tomorrow, February 18, all eyes are on [...]

Via Finterra · February 17, 2026

As of February 17, 2026, Walmart Inc. (NYSE: WMT) has officially entered a new era of corporate history. Long regarded as the quintessential "brick-and-mortar" giant, the Bentonville-based retailer recently crossed the historic $1 trillion market capitalization milestone on February 3, 2026. This achievement is not merely a reflection of its scale but a validation of [...]

Via Finterra · February 17, 2026

The global financial landscape was rocked in late January by a seismic shift in Federal Reserve leadership expectations, triggering a historic "flash crash" in precious metals that has left investors reeling. The nomination of Kevin Warsh as the next Chair of the Federal Reserve (Fed) acted as a catalyst for

Via MarketMinute · February 17, 2026

Gaxos.ai (GXAI) shares are surging after the company struck a major deal with ByteDance's tech arm to lower costs and speed up its AI video creation tools. With additional backing from Amazon AWS for a new AI sales platform, Gaxos is rapidly expanding its footprint across the multibillion-dollar creator economy.

Via Benzinga · February 17, 2026

Investors are unfairly punishing too many stocks as part of a right-pricing of AI-related names. That spells opportunity for you.

Via The Motley Fool · February 17, 2026

Via MarketBeat · February 16, 2026

As of February 16, 2026, the American economic landscape has split into two starkly different realities, creating a "K-shaped" trajectory that financial experts warn could be the precursor to a significant market correction. This divergence—where high-income earners continue to see their wealth expand while middle- and lower-income households struggle

Via MarketMinute · February 16, 2026

As of February 16, 2026, UnitedHealth Group (NYSE: UNH) finds itself at a historic crossroads. For decades, the Minnesota-based behemoth has been the undisputed bellwether of the American healthcare system—a compounding machine that rarely missed a beat. However, early 2026 has brought unprecedented volatility to the healthcare giant. Following a catastrophic January that saw the [...]

Via Finterra · February 16, 2026

In the upper echelons of the American homebuilding industry, NVR, Inc. (NYSE: NVR) has long been regarded as the gold standard of capital efficiency. However, the market’s reaction in mid-February 2026 has left even seasoned analysts scratching their heads. On February 11, 2026, NVR’s board approved a fresh $750 million share repurchase authorization—a move that [...]

Via Finterra · February 16, 2026

Semiconductors are the foundation upon which technology is built, and this company is ringing the cash register.

Via The Motley Fool · February 16, 2026

A stock with low volatility can be reassuring, but it doesn’t always mean strong long-term performance.

Investors who prioritize stability may miss out on higher-reward opportunities elsewhere.

Via StockStory · February 15, 2026

Most investors are overlooking a critical detail about the way this semiconductor company's business works.

Via The Motley Fool · February 15, 2026

Most investors aren't fans of the plan, but they'd dislike the outcome of the alternative even more.

Via The Motley Fool · February 14, 2026

America sold a lot of weapons in January. Lockheed Martin will make the most profit.

Via The Motley Fool · February 14, 2026

Humana Inc. (NYSE:HUM) shares experienced a sharp sell-off this week after the health insurance giant issued a surprisingly conservative financial outlook for 2026. The company warned investors that a massive $3.5 billion net headwind stemming from a decline in Medicare Advantage (MA) Star Ratings would severely compress margins,

Via MarketMinute · February 13, 2026